- Does Nevada Tax Casino Winnings

- Casino Winnings Tax Rate Wisconsin 2020

- Casino Tax Rates By State

- Casino Winnings Tax Rate Wisconsin Dells

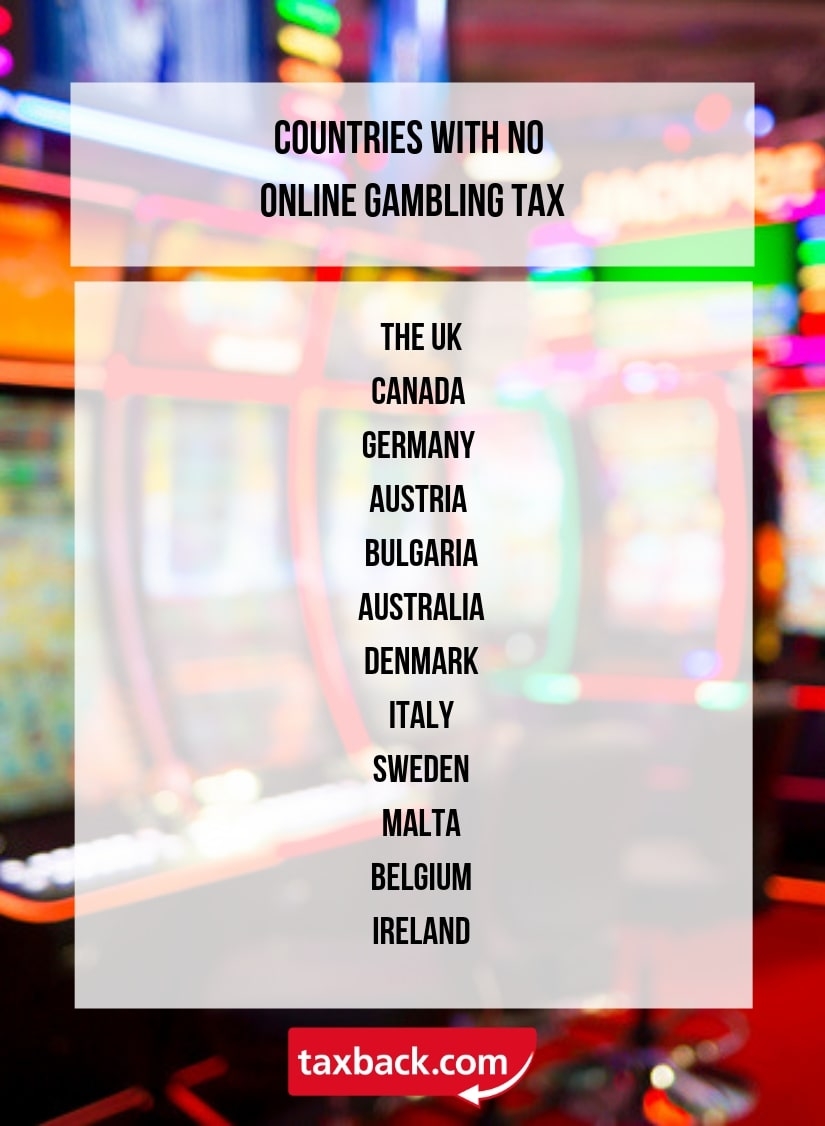

- Instead, gambling operators must pay taxes, and online gambling site operators must pay UK gambling tax duty. In the United States, the tax rate owed on gambling winnings is a flat 25%. If you win big in Las Vegas at poker, the casino must withhold the 25% when collect your cashout, and provides you with IRS form W2-G to report your winnings to.

- Your gambling winnings are generally subject to a flat 24% tax. However, for the following sources listed below, gambling winnings over $5,000 will be subject to income tax withholding: Any sweepstakes, lottery, or wagering pool (this can include payments made to the winner (s) of poker tournaments).

Lottery and Gambling Winnings

In Kenya, bookies pay 7.5% tax on all winnings they record. In 2017, Kenya upped their tax percentage rate to 35% with hopes of helping young people pursue career choices other than gambling. Meanwhile, Cambodia has lowered its tax rate drastically in a bid to encourage new businesses to invest in its gambling industry. Gambling Tax-Free Countries. Tax Rate Calculator for Gambling Winnings Most often when discussing U.S. Prize tax, it applies specifically to gambling winnings. Nearly two-thirds of Americans admit to gambling, so they face this question more often than Powerball winners or 'The Price Is Right' contestants.

Winning the Lottery or scoring on a sports wager can change your life in profound ways. Congratulations on your lucky break!

Just remember that your good fortune includes a responsibility to pay taxes and fees on those winnings.

Gambling Winnings:

In 2018, Governor Phil Murphy signed a law that authorized legal sports betting in New Jersey. The law (A4111) allows people, age 21 and over, to place sports bets over the internet or in person at New Jersey's casinos, racetracks, and former racetracks. Sports betting is now among the many forms of gambling winnings that are subject to the New Jersey Gross Income Tax, including legalized gambling (sports betting, casino, racetrack, etc.) and illegal gambling.

Lottery:

New Jersey Lottery winnings from prize amounts exceeding $10,000 became subject to the Gross Income Tax in January 2009.

New Jersey Income Tax is withheld at an amount equal to three percent (3%) of the payout for both New Jersey residents and nonresidents (N.J.S.A. 54A:5.1(g)).

Withholding Rate from Lottery Winnings

The rate is determined by the amount of the payout. If a prize is taxable (i.e., over $10,000), the entire amount of the payout is subject to withholding, not just the amount in excess of $10,000. The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows:

- 5% for Lottery payouts between $10,001 and $500,000;

- 8% for Lottery payouts over $500,000; and

- 8% for Lottery payouts over $10,000, if the claimant does not provide a valid Taxpayer Identification Number.

Companies that obtain the right to Lottery payments from the winner and receive Lottery payments are also subject to New Jersey withholdings. Each company is required to file for a refund of the tax withheld, if applicable.

LotteryNew Jersey Lottery winnings from prize amounts exceeding $10,000 are taxable. The individual prize amount is the determining factor of taxability, not the total amount of Lottery winnings during the year.

- For example, if a person won the New Jersey Lottery twice in the same year, and the winning prize amounts were $5,000 and $6,000, these winnings would not be subject to New Jersey Gross Income Tax. However, if that person won the Lottery once and received a prize of $11,000, the winnings would be taxable.

- This standard for taxability applies to both residents and nonresidents.

- The New Jersey Lottery permits donating, splitting, and assigning Lottery proceeds to someone else or to a charity. If you choose to donate, split, or assign your Lottery winnings, in whole or in part, the value is taxable to the recipient in the same way as it is for federal income tax purposes.

Making Estimated Payments

If you will not have enough withholdings to cover your New Jersey Income Tax liability, you must make estimated payments to avoid interest and penalties. For more information on estimated payments, see GIT-8, Estimating Income Taxes.

Out-of-State Sales:

Out-of-state lottery winnings are taxable for New Jersey Gross Income Tax purposes regardless of the amount.

Gambling winnings from a New Jersey location are taxable to nonresidents. Gambling includes the activities of sports betting and placing bets at casinos and racetracks.

Calculating Taxable Income

You may use your gambling losses to offset gambling winnings from the same year as long as they do not exceed your total winnings. If your losses were greater than your winnings, you cannot report the negative figure on your New Jersey tax return. You must claim zero income for net gambling winnings. For more information, see TB-20(R), Gambling Winnings or Losses.

You may be required to substantiate gambling losses used to offset winnings reported on your New Jersey tax return. Evidence of losses can include your losing tickets, a daily log or journal of wins and losses, canceled checks, notes, etc. You are not required to provide a detailed rider of gambling winnings and losses with your New Jersey tax return. However, if you report gambling winnings (net of losses) on your New Jersey return, you must attach a supporting statement indicating your total winnings and losses.

Reporting Taxable Winnings

Include taxable New Jersey Lottery and gambling winnings in the category of “net gambling winnings” on your New Jersey Gross Income Tax return.

Powerball prizes are subject to tax so it is not just a case of looking at the advertised amounts to see how much money you would receive if you won. The rate of withholding depends on how much you win and the jurisdiction in which you buy your ticket. A federal tax is levied on all winners of prizes greater than $5,000, while many of the participating states apply their own tax on top of this. In addition, some locations, such as New York City, levy a local tax on lottery winnings.

You can find out how much tax you might have to pay below. As it is such a complex issue, you should consult a financial expert in the event of a big lottery win so that you're fully aware of your tax obligations.

Federal Taxes on Lottery Winnings

Does Nevada Tax Casino Winnings

Lottery winnings are treated as income in the United States, so your final tax bill depends on how much money you make in total in a year, not just the amount you win in the lottery. The following table shows the federal tax obligations for a Powerball winner filing as a single taxpayer. The rates you pay may differ depending on your individual circumstances.

| Prize | Federal Tax Obligations |

|---|---|

| $0-$600 | No deductions |

| $600.01 - $5,000 | Winnings must be reported on federal income tax form |

| $5,000.01 and above | 24-37%, depending on prize amount |

Federal tax rules are consistent across the U.S. You do not have to pay tax on any prize up to $600, but you must report your winnings to the Internal Revenue Service (IRS) if you win an amount between $600.01 and $5,000. You will be issued a W-2G form to complete with your tax returns.

Casino Winnings Tax Rate Wisconsin 2020

A federal tax of 24 percent will be taken from all prizes above $5,000 (including the jackpot) before you receive your prize money. You may then be eligible for a refund or have to pay more tax when you file your returns, depending on your total income. If you win the jackpot you will be subject to the top federal tax rate of 37 percent. Players who are not U.S. citizens are subject to an initial federal tax payment of 30 percent rather than 24 percent.

Casino Tax Rates By State

Deductions for Gambling Losses

Playing the lottery is classed as gambling as far as the Internal Revenue Service (IRS) is concerned, which means that you are entitled to a tax deduction on any losses incurred. To file these deductions, you will need to keep an accurate record of your wins and losses, as well as any evidence of them, such as the tickets you bought. You must itemize the deductions on the tax form 1040, obtainable from the IRS website. The losses you deduct cannot exceed your income from all forms of gambling, including but not limited to horse racing, casinos, and raffles.

If you win the jackpot and take the annuity payout, the annual payments will be recorded individually in each tax year, and will count towards your gambling income for that year. This should be taken into consideration when recording wins and losses for tax deduction purposes.

State Taxes

In addition to federal taxes, your Powerball winnings may also be subject to state taxes. It is important to remember that the tax levied on your prize will not only vary by state but also depending on your individual circumstances.

The following table shows the rate of withholding for each participating jurisdiction, along with the threshold for when prizes start to be taxed at a state level.

| State Withholding | Jurisdiction | Threshold for State Tax |

|---|---|---|

| No state tax on lottery prizes | California, Florida, New Hampshire, Puerto Rico, South Dakota, Tennessee, Texas, U.S Virgin Islands, Washington State, Wyoming | N/A |

| 2.9% | North Dakota | $5,000 |

| 3.07% | Pennsylvania | $5,000 |

| 3.23% | Indiana | Undisclosed |

| 4% | Colorado, Ohio, Oklahoma, Virginia | $5,000 |

| 4% | Missouri | $600 |

| 4.25% | Michigan | $5,000 |

| 4.95% | Illinois | $1,000 |

| 3-5% | Mississippi | 3% for prizes from $600 to $5,000, 4% for prizes between $5,001 and $10,000, and 5% for prizes above $10,001 |

| 5% | Arizona, Iowa, Kansas, Louisiana, Maine, Massachusetts, Nebraska | $5,000 |

| 5% | Kentucky | Undisclosed |

| 5-8% | New Jersey | 5% for prizes above $10,000 and up to $500,000. 8% for prizes above $500,000 |

| 5.5% | North Carolina | Undisclosed |

| 5.75% | Georgia | $5,000 |

| 5.99% | Rhode Island | $5,000 |

| 6% | New Mexico, Vermont | $5,000 |

| 6.5% | West Virginia | $5,000 |

| 6.6% | Delaware | $5,000 |

| 6.9% | Montana | $5,000 |

| 6.92% | Idaho | Undisclosed |

| 6.99% | Connecticut | $5,000 (or winnings of $600 or more that are at least 300 times the amount of the wager placed) |

| 7% | Arkansas | Undisclosed |

| 7% | South Carolina | $500 |

| 7.25% | Minnesota | Undisclosed |

| 7.65% | Wisconsin | $2,000 |

| 8% | Oregon | $1,500 |

| 8.5% | Washington D.C | $5,000 |

| 8.75% | Maryland | $5,000 |

| 8.82% | New York | $5,000 |

Tax Calculator

Use the tax calculator below to calculate how much of your payout you would be taking home following the respective federal and state taxes that are deducted. Just enter the amount you have won and select your state. Then select if this was the jackpot or not, and if it was then choose whether you took the annuity option or cash lump sum.

Local Taxes

In addition to federal and state taxes, many cities, counties and municipalities in the United States levy a local income tax. This can vary greatly depending on the location, but in all cases it will be applied on top of any other income taxes. New York City, for example, applies a local tax of 3.876 percent in addition to the top state income tax rate of 8.82 percent and the top federal rate of 37 percent.

This means that a New York resident who opts for the cash lump sum payout of Powerball’s starting jackpot will end up with a final payout of roughly $8.4 million, just 42 percent of the advertised $20 million (*During the Coronavirus pandemic, the starting jackpot may be lower than this) prize. Being aware of these rules before you make a prize claim can protect you from the shock of seeing millions of dollars slashed from your prize money.

Taxes for Lottery Pools

If you win a large prize as part of a lottery pool, you are still required to pay taxes on your winnings. Each member of the group will be liable to pay their share of taxes, so everyone will need to report the income when filing their returns. Some states make this easy, as they allow each member of a lottery pool to claim individually through a shared or multiple ownership claim. In these cases the prize money will be paid directly to each member of the pool and the appropriate taxes will be withheld at the point of payment.

It gets slightly more complicated when the entirety of the prize money is paid to one representative, who is then responsible for distributing the winnings to other people. In these cases, anyone receiving a share of the money who is not named as the actual winner will need to complete IRS form 5754 to report the income. This will need to be filled out by every member of the group except the named claimant before the prize money is distributed. Form 5754 must be filed by December 31st of the tax year in which the prize was paid.

Casino Winnings Tax Rate Wisconsin Dells

In the event of a big prize win, you should contact your state lottery for further guidance about your tax obligations and what you need to do to report the income correctly.